The weirdly resilient consumer

Posted Under: Consumer Behavior

Jim Cramer behaves like a lunatic on his CNBC show, but he’s actuallly a smart guy sometimes. I say that of course because he’s just made a point that I agree with, in today’s WSJ. Namely, he points out that despite all the headlines you’ve seen about the any-second-now collapse of consumer spending, it never seems to happen. Consider this list of culprits that we’ve all heard are about to bring the consumer to his/her knees, he writes:

A new credit-card bill that would permanently set back the consumer by making it too prohibitive to default; a triple hurricane scourge that wrecked the Southeast coast; a natural-gas heating bill which tripled, leaving consumers devastated; a dramatic decline in the value of each American’s bedrock investment, the home; a debilitating war in Iraq that has sapped the optimism needed for robust spending; and, worst of all, a quick doubling of the price of gasoline.

And yet:

Critics are just now waking up to the fact that the consumer may very well be going through the healthiest month of spending we have seen in many years. There are plenty of ephemeral gauges, including some easily manipulated data from the Commerce Department, that reveal overall consumer spending. Nothing, however, touches retail sales as an indicator of how robust the consumer is, and those numbers being reported just now are quite simply off the charts. We are seeing numbers from the major retailers — both high-end and low, mass and teen — so strong that the consumer is not only not dead, but he’s at the peak of health.

He’s got a point — although personally I wonder what explains it, how and why it is that consumer spending seems to thrive no matter what in recent years. Here’s a link, but it will only work for subscribes, I assume.

"

"

Kim Fellner's book

Kim Fellner's book  A

A

Reader Comments

The problem with all the analyses predicting a decrease in consumer spending is that they assume that one (or several) of those triggering events will induce a higher level of rationality in consumer behavior. Which they haven’t. What’s continued to happen is that consumers have spent more and more, while earning (adjusted for inflation) less and less and, of course, saving even less. We’re well into negative savings territory as a nation, and headed further in that direction.

Absent some large-scale changes in America’s economic landscape for consumers – like, say, across-the-board wage hikes that allow people to actually pay off those credit card bills rather than continuing to tap into their increasingly expensive home equity – something is eventually going to force consumer spending growth to a drastic and unpleasant halt. The cascading cycle of mortagage-rate-inscreases followed by foreclosures followed by a large-scale, non-localized bust in housing markets (i.e., not just in housing prices but in an absolute-zero for housing starts and construction jobs) seems like a good bet. But it’s just a simple fact: at some point, people are not going to be able to keep spending money they don’t have. Which is what they’re doing now, rational or not.

well as long as people will keep lending, people will keep borrowing and buying… A good degree of the current lending apparently is coming from Chinese capital, which of course relies in a significant degree on the continuing purchases of their product by western consumers. But whether that cycle blows out of control, continues forever or pops is a pretty unanswered question…

I think the negative savings rate point is a good one. And it’s certainly related to the borrowing-and-buying point.

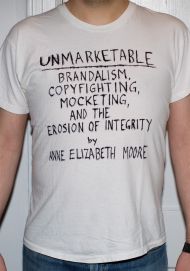

I also think, on some level, the culture of marketing must have some role in this, right? I know it’s conventional wisdom to say consumers or extra savvy and “see through” advertising these days — I just read the umpteeth story about how “consumers are in control” this morning — but at some point, doesn’t the nonstop message (buy) have some role to play here?

Just asking…